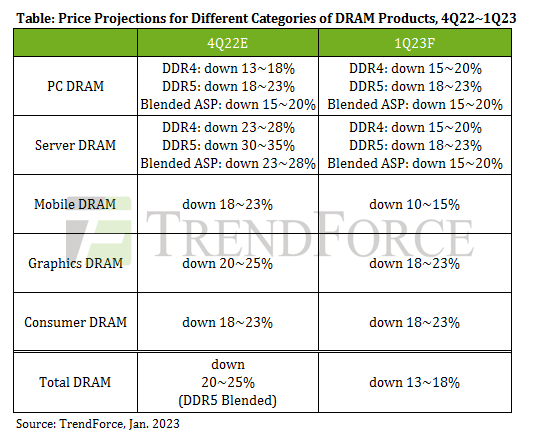

DDR5 PC DRAM will experience a drop of around 18~23%, and DDR4 products will experience a drop of around 15~20%. The ASP of PC DRAM products is projected to fall by around 15~20% QoQ for 1Q23.

DDR5 server DRAM is expected to decline by 18~23%, which is slightly more than the projected drop for experienced by DDR4 products.

The DDR5 penetration rate in the server DRAM segment is projected to reach just around 10% in 1Q23. Thus, DDR4 products are going to determine the extent of the general decline. Currently, the ASP of server DRAM products is projected to fall by around 15~20% QoQ for 1Q23.

The QoQ decline in mobile DRAM prices will narrow to around 10~15% for 1Q23.

In the graphics DRAM segment, there will be a shift in buyers’ demand from GDDR6 8Gb to GDDR6 16Gb during 2023 with graphics DRAM products based on GDDR6 8Gb experiencing more dramatic price fluctuations.

The ASP of graphics DRAM products will fall by about 18~23% QoQ for 1Q23, but the decline could get larger if suppliers continue to undercut each other.

The ASP of consumer DRAM products will fall by 18~23% QoQ for 1Q23.