CCM is driven by innovations in mobile handsets, the adoption of multiple cameras in cars, and emerging consumer applications.

Some of the CCM applications are now slowly moving from imaging to sensing.

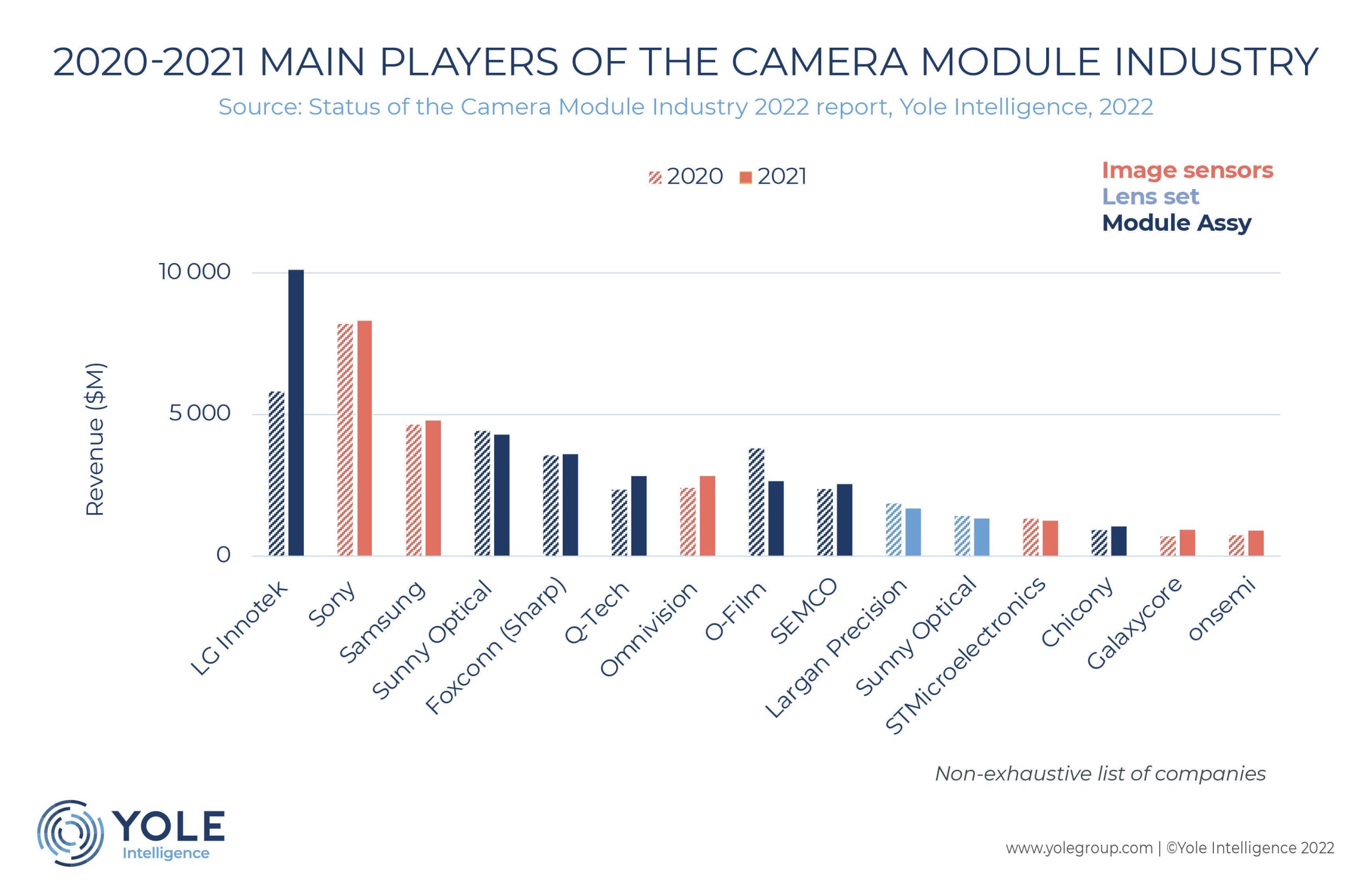

In CCM manufacturing, China and South Korea together have a market share of about 90%.

In 2021, South Korean companies were involved in Samsung and Apple supply chains.

The CCM market grew tremendously in both volume and revenue from 2018 to 2020. But then, in 2021, revenue growth fell to 5.9% year-over-year, pushing the market to $35.9 billion.

Automotive and consumer products are expected to sustain a new growth cycle beyond mobile, although this will remain the most important market.

That will lead to a €60.2 billion market in 2027 – a 9% CAGR from 2021.

“The metaverse will surely drive more camera modules into consumer products,” says Yole’s Florian Domengie, “for automotive, increasing levels of autonomy will require more cameras. ADAS , viewing, and in-cabin monitoring are integral parts of the future playground. In addition, the growing adoption of medical endoscopic solutions and security cameras will help the market thrive. The transition from imaging to sensing will sustain the camera module industry with many further opportunities”.

The whole supply chain will benefit from this industry momentum, including camera module assembly, CIS , optics, lens sets and AF /OIS actuating devices.

LG Innotek passed $10 billion in revenue in 2021, benefiting from being Apple’s supplier and serving the thriving automotive cameras industry.

In contrast, Ofilm is still suffering from the US trade ban on its partner Huawei.

Chinese and South Korean companies have about 90% of the market.

Competition in CIS has become more intense. The ecosystem is still dominated by historical leaders like Sony, Samsung, OmniVision, and STMicroelectronics, who are strong players in the mobile and consumer markets.

GalaxyCore, Onsemi, SK Hynix, and SmartSens remain solid challengers and are increasing their shares of the camera module market.

In the lens market, Largan and Sunny Optical hold over 50% of the market and leave the rest far behind.

New entrants are appearing in lens sets and AF devices, but historical top players still own high-end OIS.

Innovation is expected to shrink devices and boost imaging and sensing performance.

More light-sensitive image sensors are being developed. Wafer stacking remains a solid trend, and Sony is even introducing two-layer transistor pixels, from stacking three wafers.

The lens set is now being upgraded to seven- or eight-element (7p or 8p) levels. A 9p lens is also on the way.

High-quality optics needs more lenses but adding glass to the lens is another approach.

However, physical limitations are now slowing the pace of innovation. A new paradigm is needed, such as free-form or liquid lenses.

Metalens devices are perhaps the ultimate evolution to decrease camera module cost and volume and bring new functionalities.

For AF and OIS actuators, alternative approaches, such as MEMS actuators, are also appearing. OIS technology has updated from lens-shift to sensor-shift and even module-shift.