Wireless revenue was £46.6 million (H1 2021: £41.6m) up 12.0%.

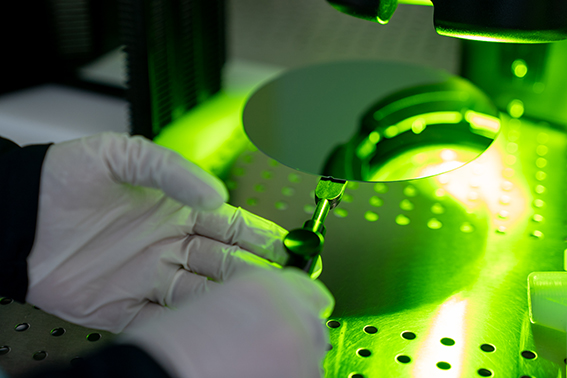

Photonics revenue was £38.5m (H1 2021: £36.4m) up 5.7%.

CMOS++ revenue was £1.1m (H1 2021: £1.5m) down 27.2%.

Adjusted cash inflow was £8.3 million (H1 2021: £9.1m)

Total net cash capex and cash investment in intangibles is £3.5 million (H1 2021: £8.1 million).

£3.8 million was invested investment in PP&E capex related to tool investments in Taiwan.

£4.1 million was raised from the disposal of assets related to the Singapore site closure

Purchases of intangibles of £2.3 million primarily relate to ongoing systems transformation programme.

There is ongoing investment in R&D with £1.6m (H1 2021: £1.8m) of development costs capitalised in the period.

The company has adjusted net debt of £6.7 million as at 30 June 2022 (net debt of £5.8 million as at 31 Dec 2021, net funds of £0.9 million as at 30 June 2021).

“The importance of compound semiconductors to a series of fundamental mega trends which will shape the global economy is gaining increasing recognition,” says CEO Americo Lemos.

|

|

H1 2022 £’m* |

H1 2021 £’m* |

Change (%) |

Change at constant currency (%) |

|

Revenue |

86.2 |

79.5 |

8.4 |

1.4 |

|

Adjusted EBITDA** |

12.3 |

11.6 |

6.2 |

– |

|

Operating loss |

(7.4) |

(1.9) |

||

|

Adjusted operating loss |

(1.4) |

(0.9) |

||

|

Reported loss after tax |

(8.3) |

(2.7) |

||

|

Diluted EPS |

(1.03p) |

(0.34p) |

||

|

Adjusted diluted EPS |

(0.36p) |

(0.21p) |

||

|

Cash generated from operations |

6.2 |

10.4 |

||

|

Adjusted cash from operations |

8.3 |

9.1 |

||

|

Capital Investment (PP&E) |

3.8 |

6.1 |

||

|

Net (debt***) / funds |

(6.7) |

0.9 |

The company expects full year 2022 revenue guidance of low single digit percentage growth as strong Photonics sales driven by 3D sensing VCSELs and emerging revenues in microLEDs offset a degree of anticipated, macro-driven, softness in Wireless.

It expects a similar adjusted EBITDA margin % to 2021 .

It is expected that full year PP&E capital expenditure will be in the range of £10-15 million and c.£8 million of capitalised intangibles relating to development costs and systems transformation.