What are the topics covered this week? There’s (the end of) auto component shortages, power module companies merging to form Semikron-Danfossmerge, chip industry growth, a new book on Arm and its company culture and Intel finding a new way to finance building US fabs.

5. Auto chip shortage could be easing

Several signs point to an easing of the shortages of semiconductors for automotive applications, says Semiconductor Intelligence. However, the production of light vehicles will likely remain below full potential through at least 2023. LMC Automotive’s July forecast of light vehicle production called for 81.7 million units in 2022, up 2% from 2021. LMC’s January forecast was for 13% unit growth in 2021, over 4 million more units than the current forecast.

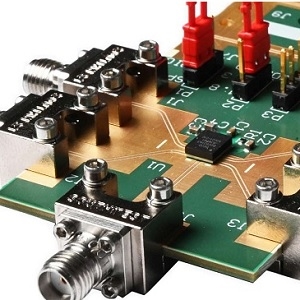

4. Power module companies merge to form Semikron-Danfoss

Power module company Semikron and Danfoss subsidiary Danfoss Silicon Power have completed their merger to form Semikron-Danfossmerge, majority owned by Danfoss. Of the two family-owned companies, Semikron is bringing in 3,000 staff from 24 subsidiaries worldwide, and there will be 500 from Danfoss Silicon Power. Where did Danfoss get resources to buy the significantly larger company? “We can’t go into the specifics of the how the deal is financed, but Danfoss is a very solid company with a very strong credit rating and years of positive cash-flow,” a spokesman told Electronics Weekly.

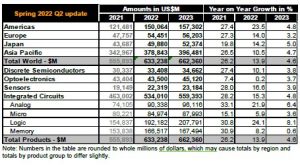

3. Chip industry to grow 13.9% this year and 4.6% next year says WSTS

3. Chip industry to grow 13.9% this year and 4.6% next year says WSTS

The semiconductor industry is expected to grow 4.6% next year after 13.9% growth this year and 26.2% growth last year, says WSTS. It forecasts industry revenues of $633 billion this year. Most major categories are expected to see high teens y-o-y growth in 2022, led by Logic with 24.1% growth, Analogue with 21.9% growth, and Sensors with 16.6% growth. Optoelectronics remains the weakest category in the forecast and is expected to be roughly flat (+0.2 percent) year over year.

2. Culture Won – an insider’s view of how Arm changed the tech industry

“Culture eats strategy for breakfast,” said the business guru Peter Drucker, and Keith Clarke, a former Arm VP and 25 year Arm veteran, endorses Drucker’s view in his book ‘Culture Won’. There was, of course, a bit more to it. If Arm ever adopted a motto it would be: “I can do better than that” – the oft-repeated remark by Sophie Wilson, one of the two designers of the ARM 1 processor, who first used the phrase about a processor designed for National Semiconductor by her Arm 1 co-designer Steve Furber.

1. Intel finds new way to finance fabs

1. Intel finds new way to finance fabs

Yesterday Intel and Brookfield Asset Management of Canada said they have developed “a new funding model [for] the capital-intensive semiconductor industry.” The companies will pay for the two fabs previously announced by Intel in Chandler, Arizona on a 51-49% basis with Intel taking the 51% share plus operating control.Intel finds new way to finance fabs “Our agreement with Brookfield is a first for our industry, and we expect it will allow us to increase flexibility while maintaining capacity on our balance sheet to create a more distributed and resilient supply chain,” said Intel CFO David Zinsner.