What are the topics covered? There’s a OneWeb and Intelsat partnership, Elon Musk selling Tesla shares, a GaN power IC maker buying a silicon carbide company, a Philips CEO departure, and reports of a possible takeover bid…

5. OneWeb, Intelsat partner for LEO and GEO inflight connectivity

OneWeb and Intelsat, the satellite comms companies, have agreed a global distribution partnership to offer airlines multi-orbit inflight connectivity. OneWeb, Intelsat partner for LEO and GEO inflight connectivityThe agreement will see Intelsat distribute OneWeb’s low Earth orbit (LEO) satellite services to airlines worldwide together with Intelsat’s existing geo-stationary (GEO) satellite service. The companies expect the multi-orbit solution to be in service by 2024.

4. Elon, Twitter, ADAS and the DMV [Mannerisms]

Elon Musk has sold $32 billion worth of shares in Tesla since November. Normally a CEO selling that much stock in his own company would crash its share price but, in Tesla’s case, it hasn’t, because Musk has a sound ostensible reason for raising cash. The reason given is that he needs to raise cash for the Twitter purchase if a Delaware court forces him to go through with it. But there may be another reason for the share sale…

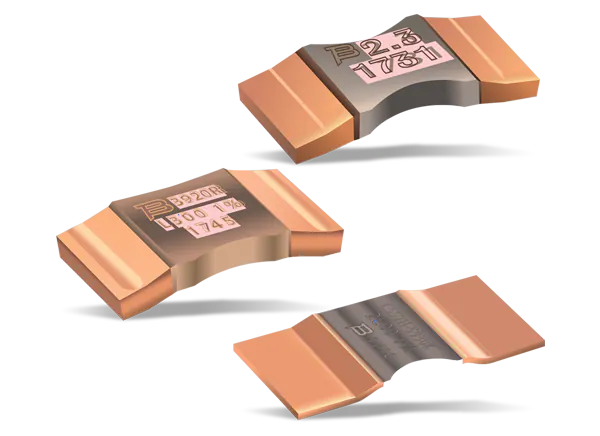

3. Navitas adds SiC company to its GaN portfolio for electric vehicles, solar power and industrial

3. Navitas adds SiC company to its GaN portfolio for electric vehicles, solar power and industrial

Californian GaN power IC maker Navitas Semiconductor has bought Virginia silicon carbide company GeneSiC Semiconductor. “Navitas GaN ICs are optimised for 400V electric vehicle systems, and GeneSiC technology is ideal for 800V electric vehicle systems,” according to Navitas. “Navitas GaN ICs serve residential solar, while GeneSiC has immediate revenue in higher power commercial solar and energy storage customers. GeneSiC high-voltage products bring immediate revenue in industrial markets…”

2. Philips CEO to leave after product recall

Frans van Houten, CEO of Philips, is to step down in October following a product recall which has halved Philips’ share price. Houten has been CEO for 12 years and was due to leave the job in April. Roy Jakobs, head of Connected Care will take over. Philips is in the middle of a recall of ventilators and machines for the treatment of sleep apnea which could lead to large legal claims. In June 2021 Philips warned that foam used for sound dampening might release toxic gases that could carry cancer risks.

1. RS said to be facing takeover bid

1. RS said to be facing takeover bid

RS may be about to get a £15 per share takeover bid, reports the Times. The identity of the supposed bidder is not disclosed. The bid would value RS at over £7 billion. At Friday’s close, the share price stood at £10.88 giving RS a market cap of £5.1 billion. The shares have risen 34% in the last six months. Last week RS bought the Mexican distributor Risoul for $275 million. For its financial year, to the end of March 2022, RS grew revenue 28% y-o-y to £2.55 billion for an operating profit of £308 million.