With TI – the leading supplier for PMICs – bringing on-stream new capacity at its RFAB2 and LFAB sites, TrendForce projects that the global production capacity for power management ICs will increase by 4.7% YoY for 1H23.

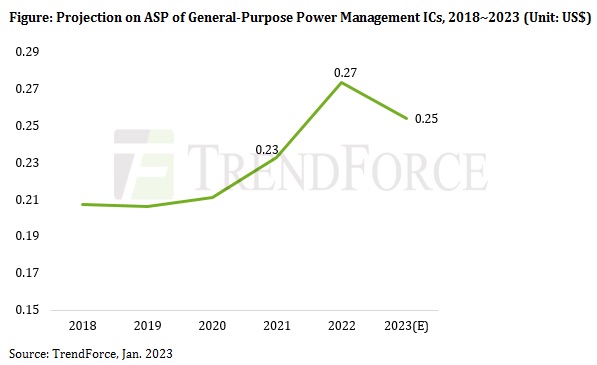

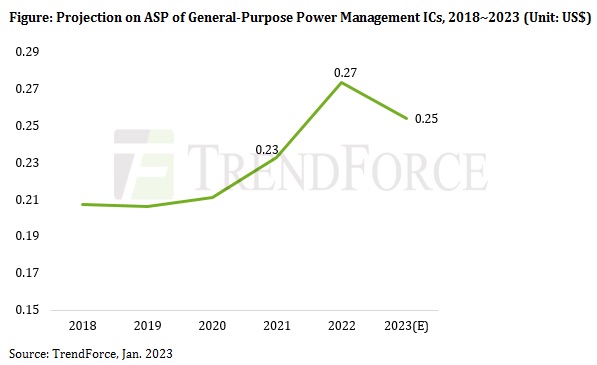

In the market for PMICs, falling demand for products in consumer electronics, networking devices, and industrial equipment continues to generate downward pressure on prices.

Consequently, quotes for power management IC orders are projected to register a sequential drop of 5~10% during 1H23.

Demand remains stable for automotive products and the demand coming from the automotive market is going to emerge as the only major driving force behind sales of power management ICs.

IDM PCIM suppliers include TI, ADI, Infineon, Renesas, onsemi, ST, and NXP.

Fabless suppliers include Qualcomm, MPS, MediaTek, Anpec, GMT, Leadtrend, Weltrend, Silergy, BPS, and SG Micro.

By shipment market share, IDMs collectively control 63% of the global market for power management ICs; and among them, TI is the leader with a 22% global market share.

PMIC prices for consumer electronics (e.g., laptop computers, tablets, TVs, and smartphones) began to drop in 3Q22, with the QoQ decline coming to 3~10%. In 4Q22, prices fell by another 5~10% QoQ for a wide range of consumer power management ICs (e.g., those related to AC-DC, DC-DC, LDO, buck, boost, PWM, and battery charger).

Demand has begun to weaken for PMICs used in networking devices and most kinds of industrial equipment. The only applications that still exhibited stable demand were a very few specific kinds of industrial equipment (e.g., military hardware) and automotive products.

IDMs together hold a market share of more than 83% for power management ICs embedded in industrial equipment and automotive products.

Fabless PMIC suppliers have an average lead time of 12~28 weeks. However existing stock is so large for some PMIC types models that fabless houses can begin shipments right after receiving the incoming order.

Turning to IDMs, they mostly have a longer lead time. For PMICs in non-automotive applications, IDMs have a lead time of 20~40 weeks.

For PMICs in automotive applications, IDMs have a lead time of more than 32 weeks.

On the whole, orders are still in the allocation status for automotive power management ICs that come from very few suppliers and have a drawn-out process for chip manufacturing, module assembly, and qualification.