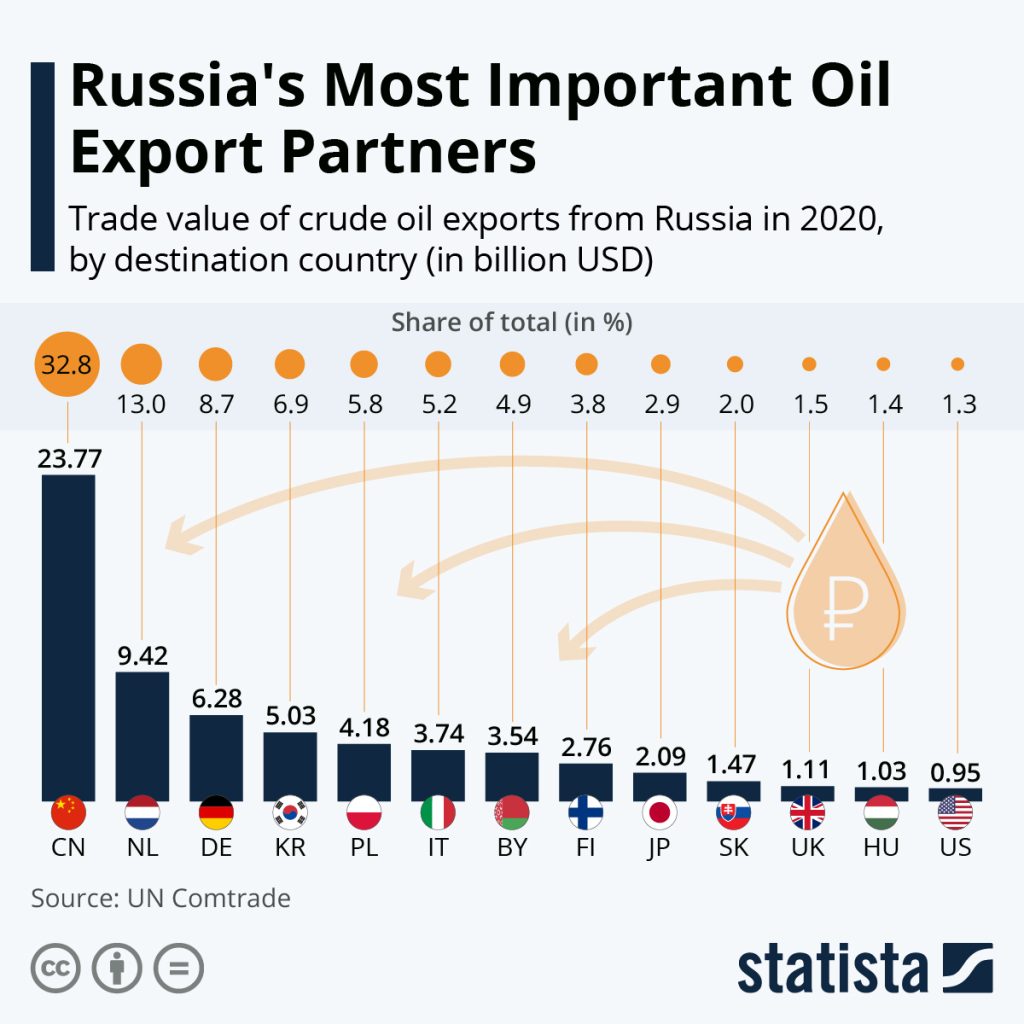

Data from UN Comtrade shows that the economic effect of an EU import stop is significant, despite China being the largest recipient of Russian oil by a large margin.

Even just taking into account the countries included at the top end of the list as displayed here, over 40% of Russia’s trade value from oil exports would be removed in the case of a complete ban – something which will become closer to reality over the next few months after pledges from Germany and Poland to stop importing pipeline oil by the end of the year, too. This would mean the ban eliminates 90% of Russia’s oil imports to the EU.

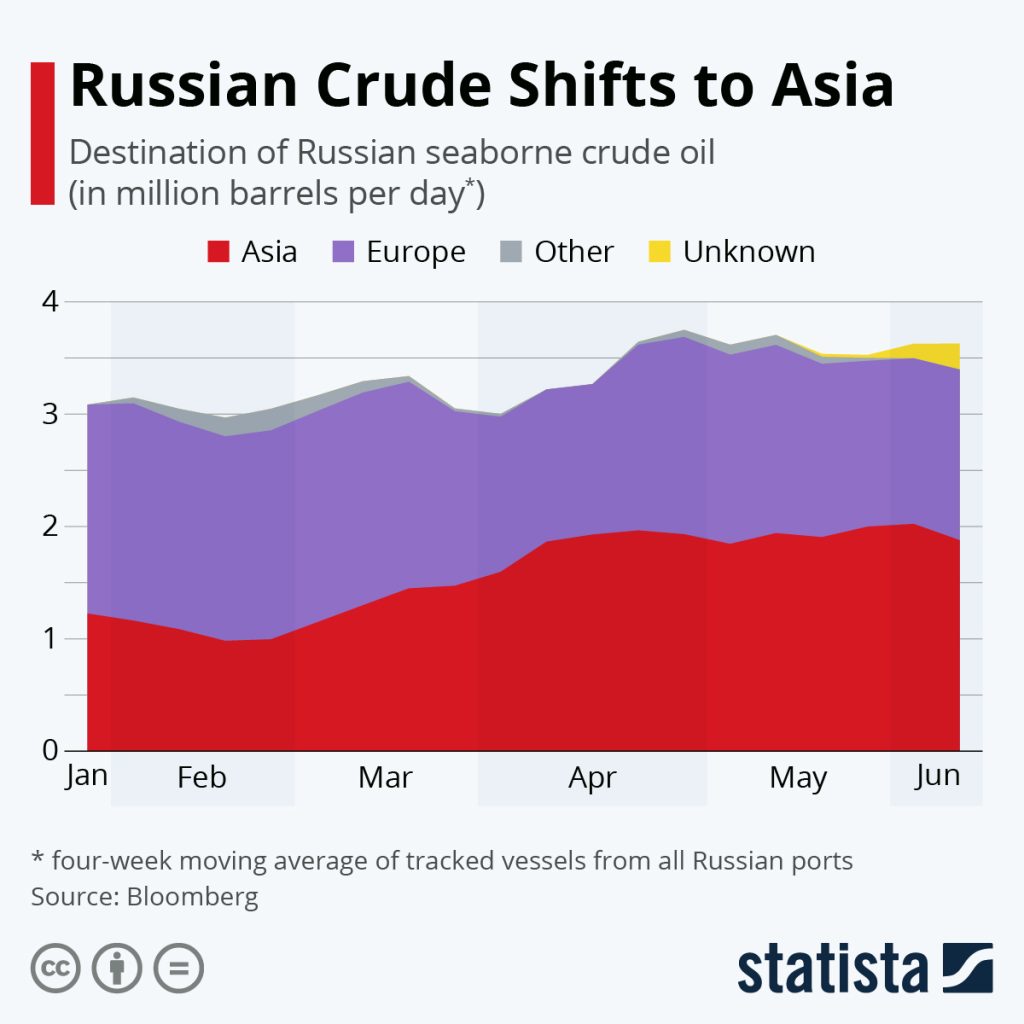

However, despite many countries taking steps to reduce or outright end their purchases of fossil fuels from Russia, the amount of seaborne Russian crude oil exports has actually increased since February with more shipments of crude oil from Russia arriving at Asian ports, an analysis of vessel tracking data by Bloomberg shows.

One country that recently increased its shipments majorly is typically receiving Russian oil via boat: India. The country has grown its daily purchases of the fossil fuel from Russia by around $65 million between February-March and May 2022, according to the Center for Research on Energy and Clean Air.

Russia’s biggest hub for shipping oil – the Baltic – had previously seen only some shipments to Asia. Between early April and early June, the continent received between 40 and 60% of weekly shipments out of the Baltic.

Deliveries to Asia were also becoming more commonplace at the smaller hubs on the Black Sea and in the Arctic, while Pacific terminals had become almost entirely dedicated to shipments headed for China as of mid-May, with those to Japan and South Korea disappearing.

Looking at all exports of Russian fossil fuels via cargo ship and pipeline, shipment sizes and their daily value actually decreased between February-March and May 2022, with the global daily export value now around $100 million lower.

The biggest reductions came from the EU-28 at around $114 million, followed by the U.S. with around $33 million.

Comparing the daily revenue of Russian fossil fuel exports to May 2021, however, Russia is still making around 40% more money from fossil fuels due to world market prices that had climbed even before its war on Ukraine had started.