The 809V EV is the answer to fast charging and, with more 800V EVs coming, SiC is expected to grow quickly.

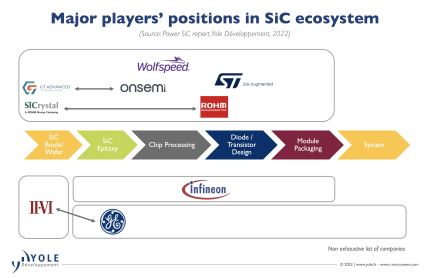

The IDM business model is the one chosen by leading players to supply devices, especially power modules.

ST is the leading SiC company, as their modules have been used in the Tesla Model 3 for some years.

onsemi, took a significant step in 2021 by acquiring GT Advanced Technologies, a SiC boule supplier.

Today, onsemi is working on the expansion of its SiC wafer capacity to support its rapidly growing SiC business

Infineon grew its SiC business 126% in 2021 in a market which had an average growth rate of 57% helped by their design-win of the 800V Hyundai Ioniq5.

developed by Infineon Technologies pushed them into the fast lane with their solid base of industrial applications. Dr. Peter Friedrichs, Vice President Silicon Carbide at Infineon Technologies AG, states: “The efficiency advantage enabled by silicon carbide perfectly matches worldwide efforts to save on electrical energy. The adoption rates will increase, not just in emerging and new applications like solar power conversion or EV charging, but also in traditional power semiconductor applications. We don’t need to promote the benefits of the technology anymore; these are really well known in the industry – which is now turning to the question of smart implementation leading to a long-term cost-performance advantage. Wolfspeed also showed its determination to focus its activities on the SiC business. The company decided on a significant re-organization a few years ago by selling its LED business and expanding its power device business. With its SiC wafer leadership,

Wolfspeed has now qualified its 8” fab.

ROHM is expanding capacity in both devices and wafers following its acquisition of SiCrystal.

II-VI demonstrated an automotive-qualified 1200V device and an extended partnership with General Electric.

SiC wafers still account for a major part of the cost of a SiC device. According to Amine Allouche, Technology & Cost Analyst at System Plus Consulting, in the SiC Transistor Comparison 2021 report: “SiC raw wafer cost represents more than 60% of the epi-wafer cost for 1200V SiC MOSFETs.”

8” SiC wafers are considered as the critical step to scaling up production.

Major IDMs are developing their own manufacturing capability of 8” SiC wafers; already, some wafer suppliers are shipping samples as of 2022.

6” will still be the leading platform in the coming five years. However, initial volumes of 8” are starting in 2022, and it will be taken as a strategic resource by market players.

To optimise the wafering process and thus produce more wafers from one single SiC boule is another approach.

DISCO has developed the laser cutting system to increase the throughput. And Infineon Technologies has qualified their Cold Split technology.

Companies have proposed very different ways of manufacturing SiC wafers. Soitec applied their SmartCut technology to produce SiC wafer with a thin layer with a lower defect rate and a handle wafer with lower resistivity.

Sumitomo Metal Mining plans to ramp up its engineered SiC wafer in the coming years.

KISAB, a Swedish start-up, provides wafer-based approaches to offer high-quality SiC wafers