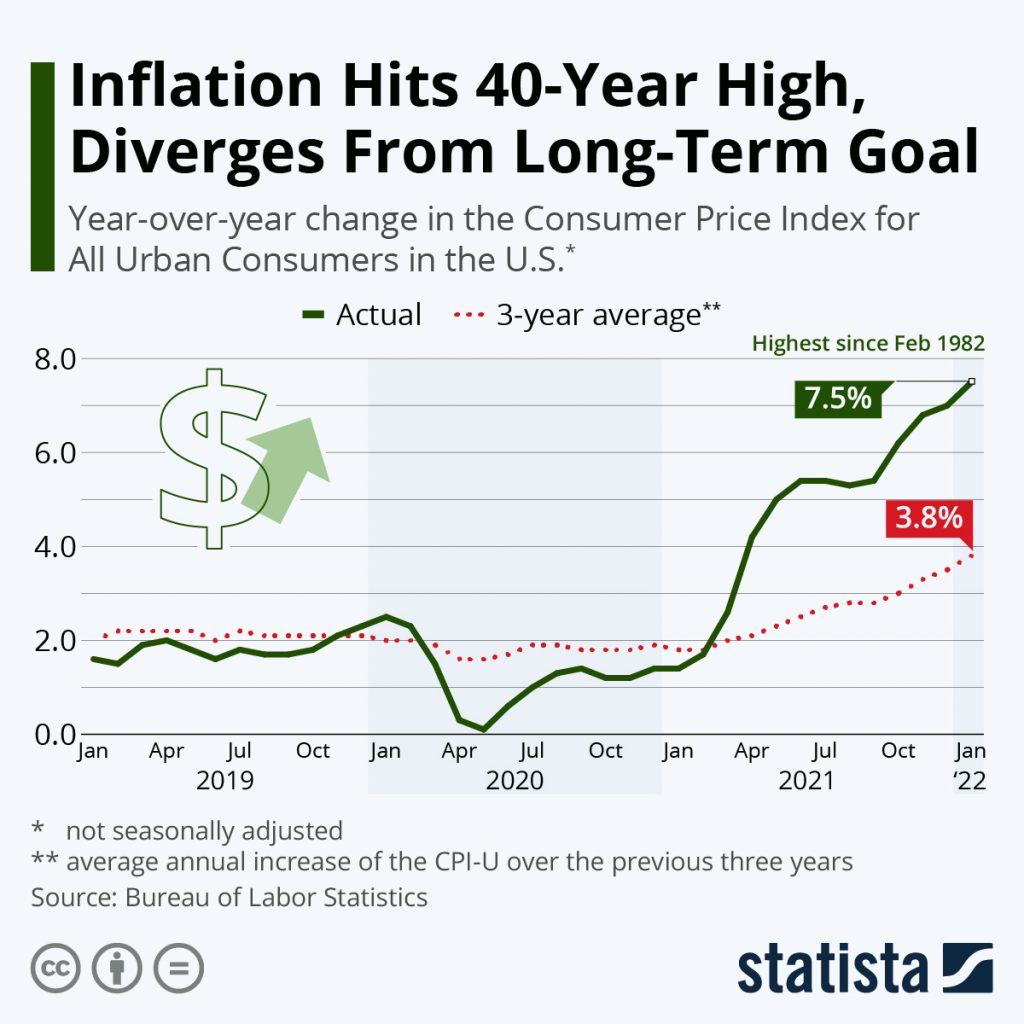

The Consumer Price Index for All Urban Consumers (CPI-U) was up 7.5 percent compared to a year ago, while the core index excluding more volatile food and energy prices increased 6.0 percent over the last 12 months.

Those were the highest readings since February 1982 and August 1982, respectively, further fueling fears that inflation is out of control.

When inflation spiked in the spring/early summer of 2021, it was largely due to the so-called base effect, caused by the pandemic’s cooling effect on consumer prices a year earlier.

At the onset of the pandemic, prices had taken a dive due to a sudden drop in consumer spending and fuel demand before slowly climbing back to their pre-pandemic trajectory over the summer and fall.

Due to that initial dip in consumer prices, year-over-year comparisons were always going to be exaggerated for a while, but that is no longer the case.

Back in April 2021, the Federal Open Market Committee said that it was going to aim for “inflation moderately above 2 percent for some time” before raising interest rates to achieve a long-term average of 2 percent inflation.

And while it remained unclear how the committee defines “moderately above” and “for some time”, it’s increasingly clear that the 2-percent goal is in danger.

To eliminate the short-term effects of the pandemic, we calculated the average annual inflation rate over a moving three-year period, yielding a curve that fluctuated around 2 percent for a long time, until it took off last summer.

In January, the three-year average inflation rate climbed to 3.8 percent, clearly indicating that the latest spike in consumer prices is more than just a statistical blip and should be taken seriously.